Table Of Content

You can accomplish much with it, as long as your goals are realistic. If you’re in a mortgage you can’t afford, going through the ups and downs of a Chapter 13 bankruptcy can be rough. Especially if you qualify for a fresh start under Chapter 7 bankruptcy.

Mortgage Arrearages while in Chapter 13

Nothing would remain for creditors after paying storage fees, sales costs, and the amount owed to the lender because trustees must pay off car loan liens in Chapter 7 when selling property. The trustee would likely abandon the car, and you'd get to keep it. You'll start by reviewing your state's bankruptcy exemptions.

How Do Bankruptcy Exemptions Work?

Aaron expected the lender to ask the bankruptcy court for permission to foreclose during the bankruptcy case. However, the lender waited until after the Chapter 7 case ended to resume foreclosure and recover the house. Chapter 7 eliminates qualifying debt within a few months of filing, quickly providing financial relief to people with minimal property and income. However, because Chapter 7 bankruptcy is a streamlined bankruptcy chapter, it doesn't provide long-term financial solutions or tools to help homeowners keep homes. Bankruptcy offers helpful financial options, but not all filers can protect a home in bankruptcy.

Your Home and the Chapter 7 Bankruptcy Trustee

Some loan types require a waiting period after the bankruptcy is over, while others don’t. It’s important to be able to rebuild your credit in any case before applying again. Bankruptcy has a long-term effect on your credit report and score.

Filing for Bankruptcy - Ramsey - Ramsey Solutions

Filing for Bankruptcy - Ramsey.

Posted: Tue, 02 Apr 2024 07:00:00 GMT [source]

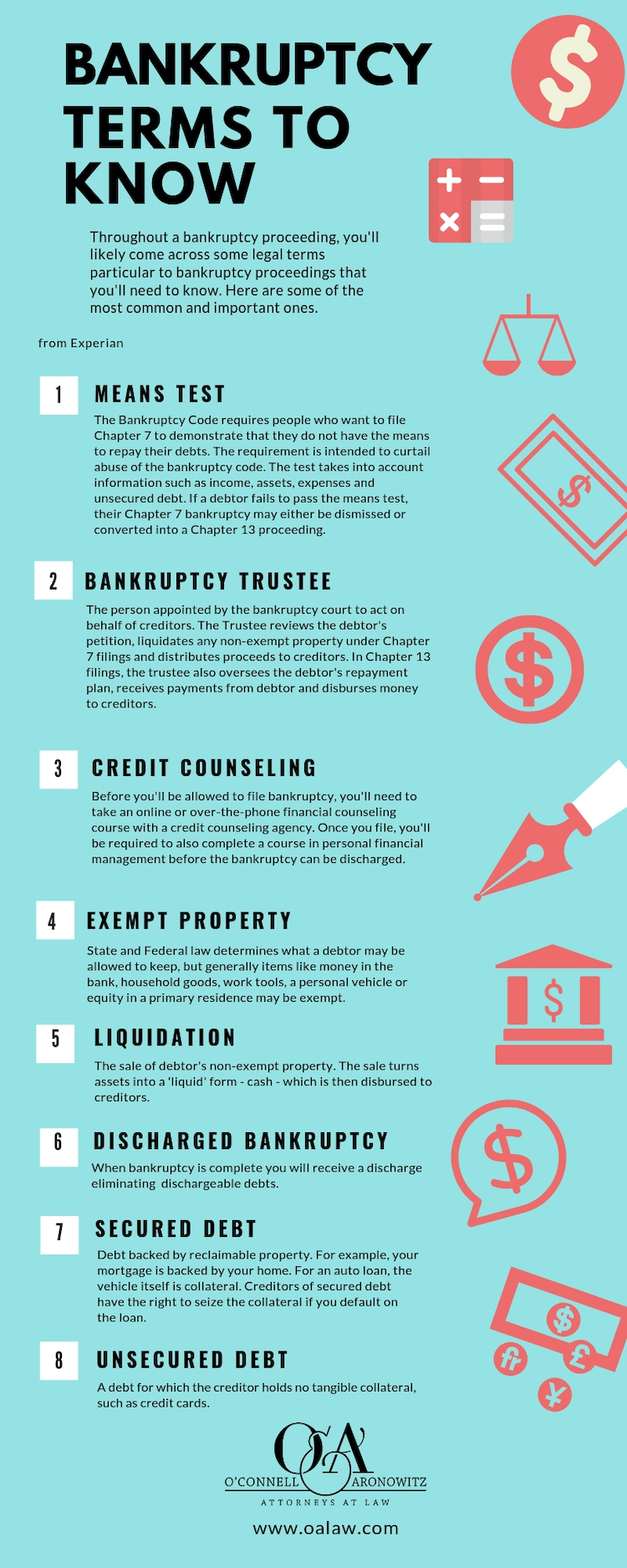

If you're considering filing for bankruptcy, you might have images of repo men coming into your home, taking your possessions, selling them to the bank, and leaving you empty-handed. But, in reality, there are laws that help protect your property during bankruptcy. Once you complete your payment plan, the remaining balance can be discharged. If your lender agrees to modify or refinance your loan to deal with the past-due amount, you can bring the mortgage debt current.

Specifically, the plan must include a monthly lender payment for arrearages and any nonexempt equity you can't protect with a homestead or wildcard exemption. Her state's homestead exemption covers $100,000 of the home's $175,000 equity. Home loans, like mortgages, home equity loans, or home equity lines of credit are secured debts.

Get up to $500k from your home equity.

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Because of this, keeping your home means keeping your mortgage. On the other hand, what if you have $10,000 in cash and your state only allows you to protect $5,000 in cash. The trustee would simply demand that you turn over the entire $5,000 surplus amount. This allows you to save property that is important to you and that you wouldn’t be able to protect otherwise, up to certain limits. Maureen Milliken has been writing about finance, banking, investment, entrepreneurship, real estate and other related topics for more than 30 years.

What About Chapter 13 Bankruptcy?

If you’re looking to lower your payments, you might try working with your lender for a mortgage modification after you start your chapter 13 payments. If the lender does approve your modification, you’ll have to follow up by getting approval from the bankruptcy judge. Chapter 13 bankruptcy is a legal solution for dealing with unmanageable debt. Filing chapter 13 allows people with regular income to get on a 3–5-year payment plan for paying back as much of their debt as they can afford. To file Chapter 7 bankruptcy and keep your home, you must be current on your mortgage or be able to bring it current shortly after filing. Chapter 7 can temporarily pause foreclosure proceedings, but it won’t allow you much time to pay off past-due payments to stop foreclosure altogether.

If You’re Having Trouble With Your Mortgage Payment

Keep reading to learn about the other requirements you must meet. Instead of giving up property you can't protect with an exemption, you'll pay for the nonexempt portion in your plan. If you want to keep the car, you can either reaffirm the loan or redeem the car.

Bankruptcy, obviously, is complicated, and if you’re worried about keeping your house, it’s even more so. In either case, if the bank is going to foreclose on your house and you know you won’t be able to stop it, and you plan to file for bankruptcy, file for bankruptcy before the foreclosure. If the bank sells your house after a foreclosure but doesn’t make back what you owe them on it, there is a “deficiency judgment,” which means you owe the bank the difference. If the foreclosure happens as a result of the bankruptcy, there is no deficiency judgment. As you’ll see shortly, while Chapter 13 is designed to help you keep your house, it’s difficult to do.

Although these options still have a negative impact on your credit score and you could lose your home, the credit effect isn’t as drastic as it would be with a foreclosure or bankruptcy. Finally, your lender could approve a deed in lieu of foreclosure. Under this arrangement, you sign the property over to your lender and they then sell the home. In exchange for keeping the home in good shape, your lender may forgive some or all of the difference between what you actually owe and what the property can sell for. It’s probably best to start by discussing what to do if you’re having trouble with your mortgage – many homeowners’ single biggest monthly expense. If you find yourself struggling, you have a few options for mortgage help.

She also is is the author of three mystery novels and two nonfiction books. That said, there are some financial downsides to hanging on to your house through a bankruptcy proceeding. Learn about lien stripping and getting rid of second mortgages in Chapter 13 bankruptcy.

It can be tempting to let unsecured debt default, but doing this will really hurt your credit score. Paying something may make a creditor more receptive to giving you some debt relief. If you’re a Rocket Mortgage client having trouble making your mortgage payment, you can apply for assistance online with our Application for Success.

While your mortgage is significant, it’s obviously not your only bill. Other lenders and creditors may work to negotiate with you if you can go through the process of proving hardship. If you can come to an agreement, you may be able to settle your debt, even if it’s less than what you owe.

You don’t even need the exemption if you owe more on your house than it’s worth. On the other hand, if you have a lot of equity, the bankruptcy court may determine you have to sell your home to pay off creditors. In both types of bankruptcy, there is a homestead exemption, a way to protect some of the equity you have built. It’s another element of bankruptcy designed to make it more possible to keep your house. Each type of bankruptcy is a totally different process, but in each, the idea behind exemptions is that the person needs to protect some important assets in order to get by. There are also exemptions for keeping your car and other necessary items.

They would then give you the $6,000 that's protected by an exemption and divide the remaining $3,000 amongst your creditors. If your property is exempt, you get to keep it after filing bankruptcy. If you have property that isn't exempt, your bankruptcy trustee can sell it and divide the proceeds among your unsecured creditors. The Chapter 7 bankruptcy trustee overseeing your case can't sell your exempt property in Chapter 7. Even so, the trustee won't bother selling an asset that isn't worth much. The trustee will first decide if the property will bring a reasonable amount for creditors.

No comments:

Post a Comment